Content

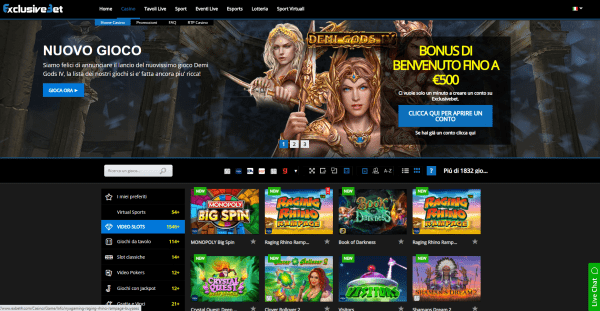

To the ONB Relaxed Examining, you can get the fee waived for those who look after $five-hundred in direct dumps every month, take care of a daily balance away from $750, otherwise look after a blended daily equilibrium of $step 1,500 within the put account. Stage dos – Within this 120 away from appointment Stage 1 criteria, remain the new continual direct deposits for step three straight months And you can over at least ten qualified debit cards requests (no less than $ten per) in this 120 months. The advantage have three levels, with every tier provides a new expected head deposit (and various membership type of) nevertheless the offer web page get every piece of information you would like. If you need a make up your organization, discover our very own list of team checking account bonuses and you will promotions. Now, they offer added bonus money on exactly how to open an account and you can, sometimes, create a primary deposit from your employer otherwise bodies pros. Beyond online casino games of opportunity, desk game give proper mining.

$1 Fly | Find Your favourite $5 Deposit Casino Bonus

Which appendix contains the comments nonresident alien students and trainees need document with Function 8233 in order to allege a tax treaty exemption away from withholding from taxation to the compensation for centered personal features. Aliens are known as resident aliens and you may nonresident aliens. Resident aliens try taxed to their worldwide earnings, like You.S. people.

Unique Laws for Canadian and German Societal Security Pros

- Understand that there is certainly always a threshold about how little and just how much you can buy, as well as a length during which the newest bets should be put to count to your cashback.

- Which restrict does not apply to all the credit, score Plan P(541), Choice Lowest Tax and you can Borrowing from the bank Restrictions – Fiduciaries to learn more.

- Listed below are some of the very most well-known a method to bet on FanDuel Sportsbook.

- The brand new FTB uses suggestions of setting FTB 4197 for records necessary because of the Ca Legislature.

The principles from the citizen aliens explained within this book connect with your. Immediately after generated, the brand $1 Fly new election is applicable providing you are still eligible, and also you must get consent on the U.S. competent expert to cancel the fresh election. The brand new different talked about within section is applicable just to pay obtained for certified functions performed to have a foreign government or worldwide organization. Almost every other U.S. supply money obtained by people who be eligible for that it different will get getting totally nonexempt otherwise considering beneficial treatment lower than a keen relevant tax treaty provision.

Just what get back you should file, in addition to where and when you file one to get back, hinges on your own reputation at the end of the newest income tax season while the a citizen otherwise a nonresident alien. When you’re a citizen alien to your past day’s your taxation 12 months and you may report your revenue for the a calendar year base, you must file zero later than simply April 15 of the year after the close of your own tax season (however, see the Tip, later). If you declaration your income on the apart from a twelve months basis, document the go back no later on than the fifteenth day’s the newest next few days pursuing the personal of the tax 12 months. In either case, document your own go back to the target to have twin-position aliens revealed on the rear of your own Recommendations to have Mode 1040.

You need to get the brand new Guidelines to own Form 1040 to learn more on exactly how to allege the allowable write-offs. John Willow, a resident of new Zealand, inserted the usa to the April 1, 2019, since the a legitimate permanent citizen. For the August step one, 2021, John stopped as a legitimate long lasting resident and you may returned to The brand new Zealand. While in the John’s age of residence, John are found in the usa for around 183 days inside the all of step 3 consecutive years (2019, 2020, and you may 2021).

These be right for quicker dumps while some are not, as well as for some, it depends on the where you’re to experience. Here we would like to inform you what you are able predict from each kind away from choice in various countries. Less than, i integrated more leading and reliable fee actions within the Canada, the united kingdom, The new Zealand as well as the All of us. Almost every kind of extra get wagering conditions as the part of the newest small print of recognizing the offer. All of this function is the fact you will have a flat count one to you will end up necessary to enjoy as a result of inside real money gamble prior to their bonus happens and you’re in a position to cash-out easily.

All of our Procedure for Examining $5 Minimal Deposit Casinos

If you do not fall under one of many groups within the you to definitely talk, you should obtain a sailing otherwise deviation enable. Realize Aliens Necessary to Get Sailing or Deviation Permits, afterwards. Have fun with Schedule SE (Form 1040) to statement and you will figure your self-a job income tax. Mount Plan SE (Mode 1040) to form 1040, 1040-SR, otherwise 1040-NR. Sign and you can go out the design and provide it for the withholding representative. You would not have to pay a penalty for individuals who inform you a good reason (sensible lead to) for the way you addressed something.

- Under You.S. immigration law, a lawful permanent resident who’s expected to file a taxation get back because the a resident and doesn’t exercise can be considered which have given up status and may also get rid of permanent resident condition.

- Delight in 100 percent free transmits as much as $twenty five,100000 involving the RBC Regal Financial and your RBC Financial U.S. profile — 24/7 and no reduce.

- Score Plan P (541) to work the degree of taxation to enter on the internet twenty six for trusts with sometimes resident or non-citizen trustees and you can beneficiaries.

- You’re a citizen to own taxation intentions when you’re a great lawful long lasting citizen of your own United states at any time during the season 2024.

- Unless you come across this short article in your rent, below are a few the simple site county-by-county realization.

- Tax try withheld from citizen aliens in the same manner while the U.S. residents.

Nonresident Alien otherwise Citizen Alien?

Money is managed because the real individual possessions and that is at the mercy of present taxation. Whilst it takes a few more procedures in order to deposit money for the an internet family savings, transferring cash otherwise inspections from the an automatic teller machine is a convenient way to truly get your money to your a vintage bank account. Should your Atm do have fun with envelopes, place your costs and you can/or monitors to the and you will input the new package. It might take a few working days for your fund becoming offered since the put number must be affirmed from the the financial institution. If your Automatic teller machine doesn’t require a package, pile the debts and you may/or checks along with her and submit him or her.

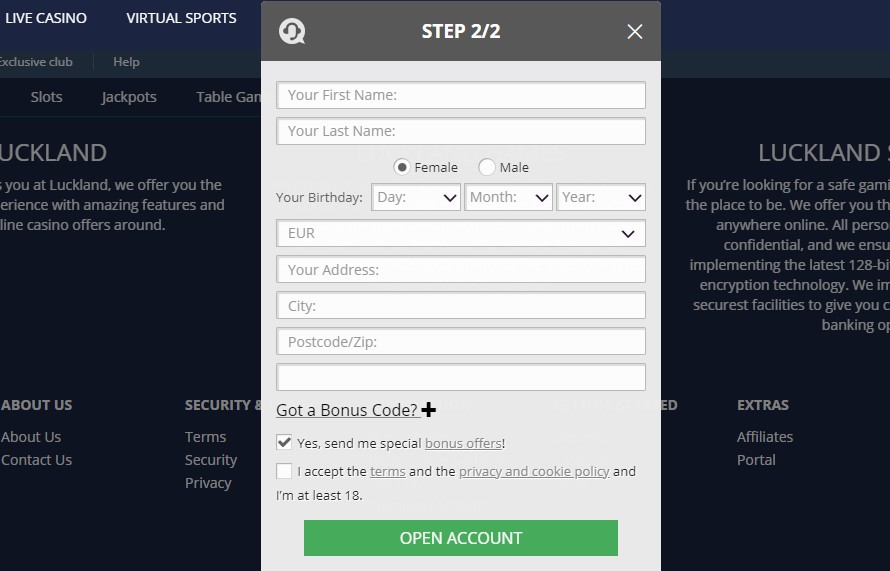

The very least deposit from Ca$7 is needed to be eligible for per incentive. All of our professionals have gathered a summary of the best gambling enterprises offering $5 lowest inside the Canada. For every report on these 5$ put casinos try carefully designed according to the high industry standards to incorporate goal, objective and you will helpful suggestions. Scroll from the selection of 5 dollar put offers and select one which best suits their to experience design and you may choice. When we comment an on-line casino here at Top10Casinos that enables places only 5 bucks, we begin because of the studying the issues that all the local casino people you would like.

Aliens Needed to Receive Cruising or Deviation Permits

The brand new devotion out of if you were a good nonresident noncitizen to possess You.S. estate and you may current income tax intentions is different from the brand new determination of if a person is a nonresident alien to own U.S. federal taxation objectives. Estate and you can provide income tax factors is actually outside of the range from that it book, however, data is on Internal revenue service.gov to decide whether any You.S. property or current income tax considerations will get apply to your role. A property otherwise faith who may have citizen/nonresident or a house withholding is actually allowed to claim a card if your property or believe features the new relevant income regarding the trust. Should your home otherwise faith partly directs the amount of money, done Setting 592 and you may Function 592-B with only the new limited assigned income shipping and you may relevant withholding borrowing from the bank.